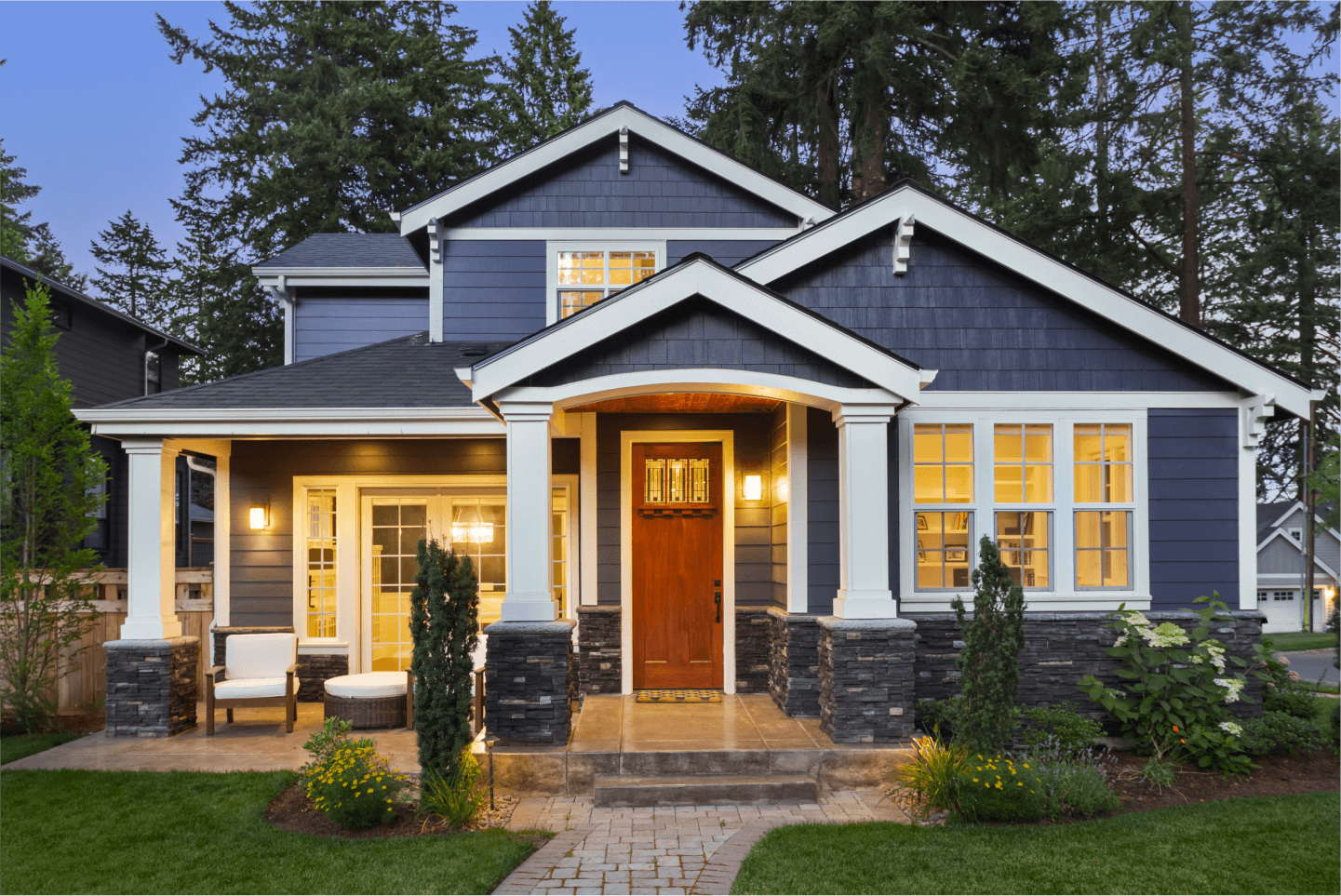

Navigate Home Purchase Hurdles: The Power of FHA Loans

Discover how FHA loans can help you overcome financial obstacles and make your dream of homeownership a reality.

The journey to owning a home is an exciting and rewarding experience, but it can also come with its fair share of challenges. From the daunting prospect of saving for a down payment to understanding complex mortgage terms, navigating the hurdles of home purchase can feel overwhelming. However, with the power of FHA loans, aspiring homeowners can gain the confidence and support they need to overcome these obstacles and achieve their dream of homeownership.

FHA loans, backed by the Federal Housing Administration, are specifically designed to make homeownership more accessible to individuals and families with modest incomes and less-than-perfect credit scores. These loans offer a range of benefits that can help potential homebuyers overcome common barriers to purchasing a home.

One of the key advantages of FHA loans is the lower down payment requirement. While conventional mortgages typically require a down payment of 20% or more, FHA loans often require as little as 3.5% down. This can be a game-changer for individuals who may not have substantial savings and are eager to transition from renting to owning.

Additionally, FHA loans are more lenient when it comes to credit requirements. While traditional lenders may be wary of extending loans to individuals with less-than-ideal credit scores, the FHA's guidelines are more forgiving, making homeownership a realistic possibility for those who may have encountered financial challenges in the past.

Furthermore, FHA loans offer competitive interest rates, making them an attractive option for first-time homebuyers and individuals looking to re-enter the housing market. This can result in lower monthly mortgage payments and greater affordability over the life of the loan.

It's important to note that FHA loans are not directly provided by the government. Instead, they are offered through approved lending institutions, such as our esteemed mortgage company. Our team of knowledgeable and dedicated mortgage loan officers can guide you through the FHA loan application process, ensuring that you have a clear understanding of the requirements and benefits associated with these loans.

To navigate the home purchase process effectively with the power of FHA loans, here are some valuable suggestions to help you reach your goal of homeownership:

1. Determine Your Eligibility: Start by assessing your eligibility for an FHA loan. Our experienced loan officers can assist you in understanding the specific criteria and requirements for qualification.

2. Explore Loan Options: Familiarize yourself with the various FHA loan programs available, including Fixed-Rate Mortgages, Adjustable-Rate Mortgages, and specialized options for first-time homebuyers. Our team can help you explore these options and determine the best fit for your unique situation.

3. Calculate Affordability: Utilize our resources and guidance to calculate how much home you can afford with an FHA loan. Understanding your budget and financial constraints is crucial in making informed decisions about your home purchase.

4. Gather Documentation: Prepare the necessary documentation, including proof of income, employment history, and financial statements, to streamline the FHA loan application process. Our loan officers can provide guidance on the documentation required for a smooth application experience.

5. Seek Personalized Guidance: Every homebuyer's situation is unique, and our team is committed to providing personalized guidance tailored to your specific needs. Reach out to us to schedule a consultation and discuss your homeownership goals in detail.

By leveraging the power of FHA loans and partnering with our team of skilled mortgage professionals, you can overcome the hurdles of home purchase and embark on the path to homeownership with confidence.

If you're ready to navigate the journey to homeownership and explore the possibilities offered by FHA loans, we invite you to reach out to us. Our dedicated team is here to provide the support and expertise you need to make your dream of owning a home a reality. Contact us today to discuss your specific needs and take the first step toward securing your future in a place to call your own.